Derrell S. Peel, Oklahoma State University Extension Livestock Marketing Specialist

So far in 2022, beef exports have increased over the record levels of 2021. The January – September period has total beef exports up 4.6 percent year over year. However, the latest data shows that exports in the month of September, were down 5.7 percent year over year, the largest, and only the second monthly decrease in beef exports in 30 months. The only other monthly decrease in beef exports since March 2020 was a 0.9 percent year over year decrease in March 2022. The recent decrease in beef exports may indicate that global economic weakness is having negative impacts on beef exports, as has been feared.

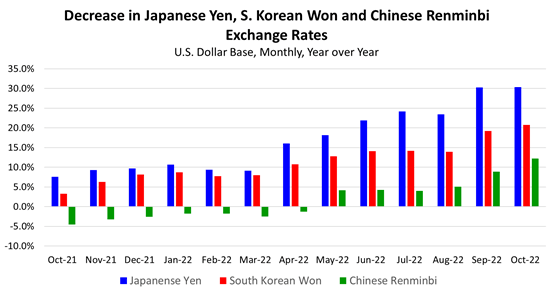

The combination of macroeconomic weakness around the world and U.S. efforts to combat inflation with higher interest rates has resulted in the U.S. dollar strengthening against many currencies. A stronger dollar makes U.S. product exports more expensive and simultaneously makes imports of foreign products more attractive. Figure 1 shows the decrease in the currency exchange rates for the three largest beef exports markets, Japan, South Korea and China/Hong Kong over the last year. The figure shows, for example, that the Japanese Yen has weakened by 30 percent in September and October compared to last year. In other words, one dollar will exchange for 147 Yen in October 2022 compared to 113 Yen one year ago. Similarly, one dollar today buys more South Korean Won and Chinese Yuan compared to last year.

The September beef export data has monthly beef exports decreasing year over year for Japan (down 7.5 percent), South Korea (down 10.0 percent), China/Hong Kong (down 3.6 percent), Canada (down 10.7 percent) and Taiwan (down 26.2 percent). Of the top six beef exports markets, only Mexico was up in September by 5.2 percent.

For the January through September period, beef exports to Japan are down 0.9 percent; South Korea is up 1.2 percent; China/Hong Kong is up 12.6 percent; and Taiwan is up 10 percent. Year to date beef exports to Canada are down 0.3 percent and down 14.1 percent for the year to Mexico. U.S. beef exports will continue to face headwinds in 2023 and beef exports will likely decrease from record levels.

U.S. beef imports decreased for the fourth consecutive month in September, down 9.2 percent year over year. Total beef imports are 6.4 percent higher year over year for the January – September period due to strong imports early in the year. Beef imports from Brazil spiked early in 2022 as a Chinese embargo on Brazilian beef in late 2021 made large supplies of Brazilian beef available. In January 2022, Brazil was the largest source of U.S. beef imports and accounted for 28.4 percent of total imports for the month. After four months of year over year decreases, Brazil accounted for 9.0 percent of beef imports in September and was the number six source of beef imports for the month. For the year to date, beef imports are up from Canada, Mexico and Brazil and are down from Australia and New Zealand.

Beef imports are expected to continue decreasing towards the end of the year but are likely to increase in 2023 as U.S. beef production falls from record levels. Domestic production of lean processing beef may decline sharply in the coming months, making beef imports more attractive, especially when buoyed by a strong U.S. dollar.